Risk management is an integral part of any business however most of the time it is simply seen as an add-on process that is often shoved into a silo to be kept away from core business functions. Now, this is no fault of business leadership as risk management has a historical reputation of being a ‘check the box’ routine or as the department who has only one answer for all risk-taking activities “NO!”.

This is simply not sustainable for our discipline as each decision made to move an organization forward requires taking risks, some large, some small, some intelligent, some fueled by greed or desperation. Whatever the motive risk leaders must play an integral part in normal business functions no matter the organizational level.

Risk leaders are often tasked with the duty to create and protect organizational value through identifying, assessing, and responding to risks that can derail the company on its path to success and subsequently raise frustration levels in the board room. Now risk experts within any organization are only as good as the data they have at their disposal, poor data equals poor recommendations, decisions, and strategies that do nothing but expose value to adverse impact.

This means it is imperative that risk leaders have the proper data needed to make smart recommendations and supply leadership with the information they need to do their jobs effectively. In a nutshell, risk leaders need to know the ins and outs of their organization within its own economic ecosystem to lead the company into the land of randomness and make it out unscathed on the other side.

One way risk professionals help collect valuable data to help with decision-making and promote intelligent risk-taking is through establishing the context before any type of risk process (e.g. assessment) is ever started. In my opinion, this is one if not the most important step in the risk management process. Without properly establishing a holistic organizational context it is difficult if not impossible to create an internal environment where the probability of quality decisions is heightened to any significant degree.

What is establishing context mean exactly?

Google Dictionary defines context as, “the circumstances that form the setting for an event, statement, or idea, and in terms of which it can be fully understood and assessed.” So when establishing the context for risk management processes the stage must be set for quality decisions to flow from. To set the stage leaders need to establish the environment in which the business exists, taking into account both internal and external parameters such as political stability in global operations to the internal culture of the organization.

All of these parameters play an active role in deciding where the business is going, and which risks can have the highest probability of adversely impacting meeting objectives. Now that we have briefly defined context let’s look at three analysis models that help risk and business leaders set the stage where risks can be identified, communicated, and planned for accordingly.

3 Analysis Models to Help Establish a Holistic Context

SWOT

SWOT analysis is a well-known strategic planning technique used to help organizations identify strengths, weaknesses, opportunities, and threats related to the business within its current market. A SWOT matrix is separated into four quadrants that are split into two separate categories. Strengths and weaknesses look into internal factors specific to your business while opportunities and threats look at the external environment in which your business exist.

The four quadrants include:

Strengths – Strengths are qualities that distinguish your organization from the rest of the market. For example, your business’s core competencies would always be strengths that help it scale and earn profits in its respective industry, without strengths a business will simply cease to exist or slowly fade into obscurity.

Weaknesses – Weaknesses are areas of improvement where your business could do better to improve its position within its market. This part of the assessment requires a shot of truth serum and deep self-awareness. One strategy to help identify weaknesses is to research competitors and see why they are doing better than your business at attracting and retaining customers. This part of the SWOT analysis is critical to help drive continuous improvement initiatives within your organization.

Opportunities – Opportunities are pretty self-explanatory but describe areas or openings for the business to capture additional market share, increase profits, scale the business, or even enter new markets if the chance is provided. Examples of opportunities include an untapped market need, exploiting a competitor’s weakness, favorable changes in regulations, and changing demographics. Risk leaders should play an integral role in assisting leadership in exploiting opportunities by supporting intelligent risk-taking. In the end, businesses who exploit opportunities have the greatest advantage to capture their market and create long term sustainable growth.

Threats – Threats are any external factors that pose a danger to the success of your business. It is an imperative part of risk management to identify threats and prepare for each one accordingly. For risk leaders threats are often identified during the risk management process after the context is established, from here these threats can be analyzed and responded to avoid any adverse impact on the business. Examples of threats to the business can be regulatory action(s), supply chain risk, evolving technology, and talent retention/acquisition.

PESTEL

Another staple in strategic planning is a PESTEL analysis (also referred to as a PEST analysis). I prefer a PESTEL as it also identifies environmental and legal factors that are becoming increasingly more prevalent in today’s global business discussions. The overall purpose of this analysis is to create a holistic view of your organization’s operational conditions and strategic positions.

The analysis looks at five external categories:

Political –governmental factors that to some degree intervene in the economy. There are not many businesses existing where political decisions do not impact operations in some form or fashion. For example, the Dodd-Frank Act restricting certain activities by lenders and banks to better protect consumers.

Economic –factors tied specifically to the economy which impact your business’s ability to earn revenue. Economic factors directly impact performance and ability to earn profits. One example is interest rate increases adversely impacting the auto industry’s ability to sell new vehicles.

Social (Socio-cultural) –factors that outline shared beliefs and attitudes of geographic populations, including things such as population growth, demographics, and health awareness. In today’s global economy consumers hold all the power and businesses must find how to customize their product or service for their target markets. An example would be a fast-food business looking to place healthier options on the menu to draw in more health-conscious customers.

Technological –factors that impact marketing and management in the way products and services are produced, distributed and communicated. Examples include the emergence of cloud-based platforms, automation of internal processes and social media. Businesses are all turning to the power of technology to help them gain an edge over competitors to capture a bigger piece of their market’s pie. This is one area that must be reviewed constantly as technology rapidly changes every day.

Environmental – factors include the consumer markets’ attention to how products and services are provided within an environmentally conscious manner to address certain global issues. These issues range from generation of raw materials to climate change. An example of environmental factors would be the impact of shareholder activism on businesses that are responsible for or connected to the production of fossil fuels.

Legal – factors that impact how your business operates in a manner that abides by legislation that governs its specific industry. Factors include employment legislation, health and safety, trade regulations and even intellectual property laws. Any area where a company can run into adverse legal situations needs to be evaluated to avoid unnecessary actions that can impact the bottom line and even the survival of the business. Furthermore, this factor becomes even more important if a business operates on a global scale as legal environments vary greatly from country to country.

Economic Moat Analysis

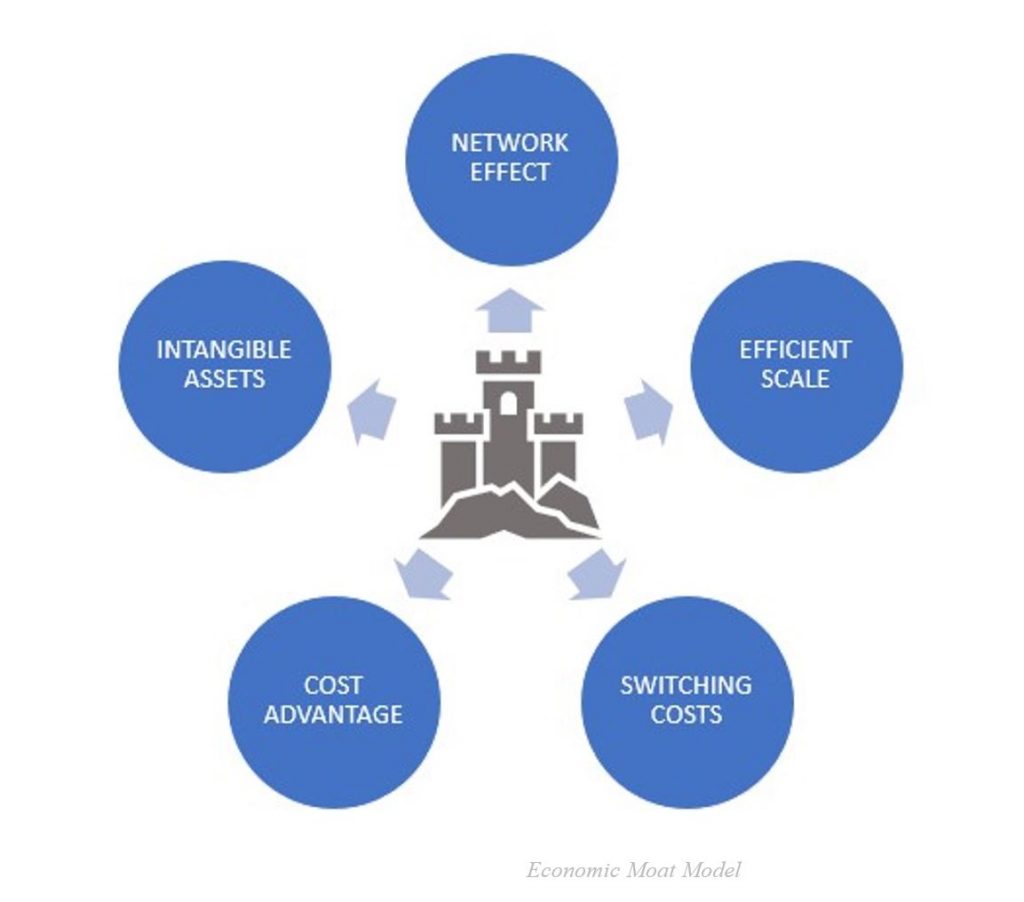

Economic moat analysis is something I was introduced to in a financial MBA course and was pioneered by the financial services and research firm, Morningstar. Morningstar uses the economic moat methodology to rate a business’s market performance based on two factors: (1) sustainable competitive advantages and (2) the probability of generating positive economic profits for a decade or more. When you think of an economic moat think of a medieval castle with a body of water surrounding it filled with anything from spikes to alligators to ward off enemies, or in business terms, your competition. The economic moat methodology analyzes five sources that can produce a ‘moat effect’ for a business to ward of competitors and new market entrants.

These sources include:

- Network Effect – the value of a particular good or service increases for both new and existing users as more customers use that good or service (e.g. smartphone adoption)

- Intangible Assets – a broad category that looks at brands, patents, regulatory licenses or any other intangibles which can distinguish your business from others in your market (e.g. strong patent protection)

- Cost Advantage – pricing factors that allow your business to have sustainably lower prices than competitors (e.g. geographic location)

- Switching Costs – expenses a customer would incur to change from one producer or provider to another (e.g. switching from Apple to Android devices)

- Efficient Scale – a dynamic in which a market of limited size is effectively served by one company or a small handful of companies (e.g. pipeline industry)

Although mainly financially driven this analysis is a great tool for risk leaders to understand at a deeper level exactly what helps their organization differentiate from their market rivals and helps focus activities on critical operations which help drive competitive advantages. In a rapidly changing global economy it is crucial for businesses to stay ahead of the competition curve with barriers to entry dropping lower by the day due to technological advancements. Risk leaders can play an active role in helping drive their business forward through intelligent risk-taking versus sitting back and waiting to solve problems once something adverse occurs.

Wrapping Up

For risk leaders to be successful in their roles they must become experts beyond the realm of risk management methodologies and strategies. They must also be fully embedded in their business’s internal and external environments to build a thorough context on which the risk management process can be executed. The better we know our organizations and their attached ecosystem, the better we, as risk leaders, can respond to threats, exploit opportunities, and actively assist in the achievement of strategic objectives. Let’s all start building the context needed to drive quality decisions leading to sustainable profits and growth for years to come.