There are basically five strategies which can help you in allocating your risk management. 1. Learn about the company If you’re going to put money into the stock market, you need to devote time and energy to learning about the company’s financial statements and annual reports, as well as the state of the economy at […]

Options

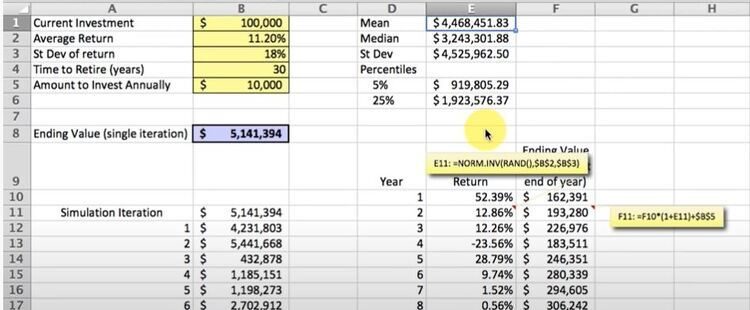

Stock Portfolio Monte Carlo Simulation in Excel

Introduction Monte Carlo simulations are currently the most common used techniques to estimate the risks that a Bank or firm might be facing at a given time. A Monte Carlo simulation is no more than a series of predictions for possible future events. Once the simulation has run, (virtually) millions of its results will produce […]

151 Trading Strategies

Brand new book “151 Trading Strategies” (freely downloadable 257-page preview version https://ssrn.com/abstract=3247865) gives detailed descriptions for 150+ trading strategies for stocks, options, fixed income, futures, ETFs, indexes, commodities, foreign exchange, convertibles, structured assets, volatility, real estate, distressed assets, cash, cryptocurrencies, weather, energy, inflation, global macro, infrastructure, and tax arbitrage. Some strategies are based on machine […]

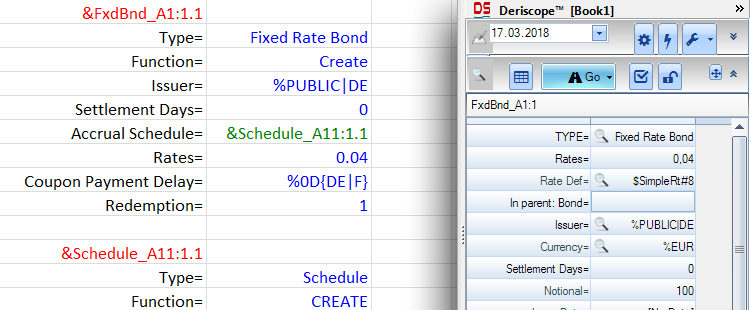

Market and Model Risk Management in Excel for free

Market Risk Management is a complex field that demands, among other things, three fundamental aspects: Access to market data – both real-time and historical; A good understanding of the applicable valuation models and, above all; Available implementations of at least a few of these models. In addition, these models must be implemented in a user […]

EBOOK: Value-at-Risk – Theory and Practice

“Value-at-Risk – Theory and Practice” second edition is an eBook written by Glyn A. Holton and published in 2014 by the author as a full web based totally free eBook, available in www.value-at-risk.net. If you want to learn in depth about VaR, this is definitely the eBook for you. Don’t miss this great opportunity. About the […]

FREE COURSE: Financial Engineering and Risk Management Part I

Created by Columbia University, this course ranges concepts from finance, economics, mathematics, statistics, engineering and computational methods. The main focus if the course is on financial engineering and risk management, where the use of simple stochastic models to price derivative securities in various asset classes including equities, fixed income, credit and mortgage-backed securities is also […]

FREE COURSE: Financial Markets

This is a great opportunity for anyone who wants to improve their knowledge in Financial Markets. It’s a FREE course created by Yale University and starts on Jan 23. A summary of the course content and syllabus is explained below. Course Syllabus Week 1: Basic Principles of Finance and Risk Management (5 videos, 1 reading) Reading: Optional […]

Top 5 Risk Management Trading Rules

Portfolio managers (PM) and traders make investment decisions everyday which translate into risk positions in their books. These decisions are mostly supported by strong fundamental views and solid convictions, based on the PM’s or trader’s view on how the market will move and how will these moves affect their positions. There are several techniques that a PM or trader […]