Banks have taken serious steps post-financial crisis to improve and even totally overhaul their Risk Management processes and systems . This has been an enormous challenge for banks as the industry regulation has increased exponentially post-financial crisis with capital and liquidity requirements also increasing. At the same time, CEO’s must keep their focus on increasing banking revenues to 10-15% in the next 3 years while navigating in an unprecedented low interest rate environment.

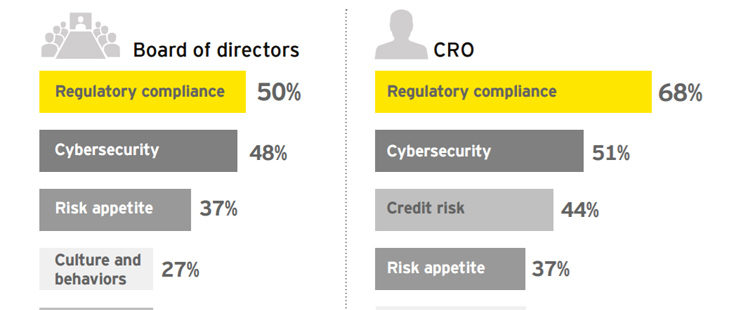

EY’s study (below) in collaboration with the Institute of International Finance (IIF) estimates that banks are halfway through a 15-year risk management transformation. This paper also explores what should be the next stages of the journey. While banks have made good progress, they need to continue making changes to achieve their growth targets – and those of their investors.