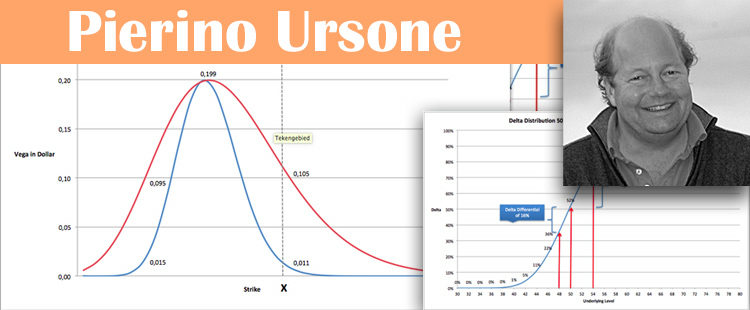

Pierino Ursone has more than twenty years working as a professional Options trader in the equity and commodity markets (half of it as a Market Maker in Equity Options, the other half as a Proprietary Options trader in the Energy Markets). He has authored Amazon’s popular book How to Calculate Options Prices and Their Greeks: Exploring the Black Scholes Model from Delta to Vega (The Wiley Finance Series), which was published by Wiley in 2015 worldwide.

Nowadays, Pierino heads Ursone Derivatives, a company active in options, energy & derivatives training, providing sparring sessions, lecturing and options strategy advice. Pierino is also owner of the European Option Academy (EOA), a provider of training and education in the Dutch financial markets since 1996. Pierino is also a fan of writing mind challenging riddles related to Options and the Greeks.

Despite his very filled agenda, Pierino was happy to concede an exclusive interview for Risk Management Guru. Pierino’s extensive expertise and knowledge on Derivatives combined with his pro active teaching personality made him a perfect subject for an interview for our blog. We hope you enjoy this interview as much as we did.

Risk Management Guru (RMG): many thanks for accepting this exclusive interview. May I start by asking about your background? How did you make your way to Financial Markets and started working as an Options Market Maker?

Pierino Ursone (PU): When I was at University, I was studying History of Art and Law school at the same time. I was determined to become a criminal lawyer, however at a certain moment my father decided not to sponsor me anymore for I was already studying for 6 years. He advised me to look for a part-time job, financing my law studies myself. At that time a fraternity friend of mine, who knew that I was interested in the financial markets, found an Optiver advertisement where they were looking for Options Market Makers. With one other guy I succeeded for the mathematical tests, leaving around 300 people behind us. The other guy decided not to take the job offer, so at that time I was the only one joining Optiver in that round in 1992. Obviously, I never finished my Law school since I was on a full time job on the floor.

RMG: are you naturally a numbers type of person? In your opinion, does a successful trader need to have first and foremost a numbers acumen?

PU: Yes, I have always been very strong in mental arithmetics. On the options floor being the fastest in calculating most certainly reaped profits, especially in combination orders; that’s why a lot of companies introduced mathematical tests. Next to that, a trader needs to be able to make a quick decision on certain occasions. Sometimes there is only one “milli-second” for making the calculation and the right decision. If someone is not strong in numbers, he will often be too late, will miss trades, will make mistakes and most probably will not know his exact position. A numbers acumen is a prerequisite!

RMG: how actively do you trade nowadays? Do you trade mostly for yourself? What are your current exposures (if you can mention…)?

PU: Besides some small stuff, I am not doing that much, I am on the sideline for quite some time already. Trading requires a lot of attention; nowadays I don’t have the time to fully focus on trading. In 2008 I was convinced that a financial meltdown was close. I bought physical gold which made a good return, however I kept it in a bank safe, which was actually not very smart. When a financial meltdown would have happened, I don’t think that my bank would have opened its doors to let me fetch my gold. Smart trade, stupid execution!

RMG: tell us about your riddles – do you create these riddles mostly for your intellectual challenge? How do your readers react to the riddles?

PU: I love these riddles. Unfortunately I haven’t created more than two riddles so far, but it’s good fun. When one would have the right approach towards options these riddles are not very complicated. It is about knowing how the greeks are distributed in time, volatility, underlying level and strike. For instance when time would quadruple, the vega of an at the money option will double etcetera. When volatility would change, the vega will remain the same for at the money options and so on. It is my view that when you understand the four- dimensionality of options and know exactly how the greeks are distributed (under changing circumstances) you will understand everything about options and especially how strategies will evolve. I have had very good feedback on those riddles.

RMG: your book is a worldwide must read for anyone who is interested in knowing more about Option prices and using the Greeks. How successful was this book, seeing it from the author’s eyes?

PU: To be honest I expected more out of it from a sales perspective.

In November 2015 Brenda Jubin wrote a very nice review about my book on the Seeking Alpha website which really made me cheer when I read it on a Sunday morning, I was very proud. In January 2016, the Spreadhunter Team from Chicago reviewed my book and ranked it No # 4 in the top ten of best option books, amongst authors like Nassim Taleb, John Hull, Larry McMillan and Sheldon Natenberg. Putting me on this list was a huge compliment. So for me, emotionally, the book was very successful.

RMG: financially, was writing a book a good bet for you? When do you plan to publish the next one?

PU: I am still waiting for sales to pick up somewhat, but I think that it needs time for people to acknowledge/ understand the added value of the book. I am thinking of writing a Dutch options book for private investors. It will be completely different; no topics like gamma hedging strategies or how to play with vomma or veta and things like kurtosis. The focus will be on understanding options strategies and, of course, knowing how the greeks can impact your strategy.

RMG: you seem very eager to share your knowledge so teaching classes and courses is probably natural for you, do you agree?

PU: I am a firm believer in sharing knowledge and I like teaching classes. What I do like the most however are sparring sessions with (options) traders. It is great to discuss with people who have a lot of knowledge about the intricacies of options and their greeks, something I have done a lot with my friends and competitors when we were trading on the floor.

RMG: how does such a historically low interest rate environment affect your views and trading strategies?

PU: When talking about (almost) negative interest rates, I am truly amazed we came this far. I remember a quote from [Jamie] Dimon: “I think it’s (negative interest rates) going to have a lot of unintended consequences that we don’t understand and you guys will be writing books for 50 years on it — what we could have done, should have done, might have done, and what we learned.”

To me it feels the same.

But now we’re in this low interest rate environment and then I think: What will happen when rates are going up again? really going up. And that scares me.

RMG: in your opinion, given the current environment and age, where do you think the best trading opportunities might be?

PU: I like the diversity of commodities. I have traded equity options for approximately 10 years and commodity/ energy options for also around 10 years and when comparing trading, one can find volatility increasing when the equity market goes down and vol decreasing when the equity market goes up. In the commodity markets I’ve seen it going all directions, vol up (exploding) or down when market going down, but also vol up (exploding) or down when market going up. It makes it more complicated in setting up strategies, but also more challenging. I think there will be many more opportunities in the commodity markets. Actually, recently coal prices exploded which had on its turn an impact on other energy sectors. In general: trading opportunities keep coming, volatility is part of our daily life and will not vanish.

RMG: Delta, Gamma, Vega, Theta, Rho – which one is your favourite? What I mean is, which Greek measure has given you the most, both in terms of challenge as in terms of P&L? Which measure is the risk manager’s “best friend”?

PU: GAMMA! When I first started trading options, Optiver handed me a large gamma short position in Dollar Guilder options, just when the UK withdraw from the ERM (European Exchange Rate Mechanism) on “Black Wednesday” in 1992. That position really made money after a few months and I had the feeling that a gamma short position was the only way to make money. After having been really hurt by my gamma short position in 1996, I decided never to have a gamma short position anymore. In 1998, I made a killing with my delta short and gamma long position on the back of the Asia Crisis and the collapse of LTCM, but in 1999 I got hurt by the time decay of my gamma long position. It was always the gamma! Later, when trading the energy markets, all was about setting up the right position/ strategy. Having a gamma position was part of the strategy, at what level do you want to be gamma long? and at what level do you want to be gamma short? (Kurtosis?) What kind of vomma position you would like to have? I was thinking much more in scenario’s instead of just being gamma long or short all the time and having a preference for one of the two. I liked setting up trades where the gamma position could alternate; short when not much was going on (market rangebound; negative kurtosis sometimes) and gamma long when new levels were met in the market for instance.

The Risk Manager’s best friend is the scenario analysis of a position. Tracking P&L distribution in a (large) range for the underlying, volatility and time. Several times I have met risk managers trying to impose gamma limits, that makes no sense. Obviously Delta, Vega (and Rho) limits should be in place.

RMG: in your profession, have you had experience with other instruments and asset classes such as FX, Futures, Equities and Bonds? Why focus on Options?

PU: FX, Equity Indices, Equities, CO2 & Energy Commodities. Options are such great tools, you can construct so much with them. Especially when being in prop trading and having to trade on your views of the market, options are great instruments in creating the most leverage when your anticipated view ends up to be the right one. The tricky thing is that if you have three scenario’s like: the market stays range-bound, market will go up or market will go down you can create a winning strategy for two out of three scenario’s. In one out of three scenario’s you will get hurt. So you have to be right with your market assessments. When that one nasty scenario will take place, you will need to respond quickly to mitigate your losses. I really like the challenge in setting up a good strategy.

RMG: speaking specifically about Risk Management, how deep and sophisticated skills do you think a risk manager or a portfolio manager must have to be able to use risk measures such as the Greeks to his/her favour, to really help him/her reach decisions, support trading strategies or mitigate possible risks?

PU: I keep emphasising that options should be approached in a four-dimensional way (P&L versus underlying, volatility and time) and not the two dimensional approach as you see so often when an options strategy is depicted in books or articles (P&L versus underlying at expiry). An options strategy has a life and during that lifetime the greeks are making or breaking the strategy. Knowing the greeks is a prerequisite for understanding options strategies. When not knowing the greeks you will never understand this four-dimensionality.

RMG: what is your view about Banking and Financial Services regulation nowadays? Do you think the Finance world has gone “from no regulation to over regulation”?

PU: Everything is over-regulated nowadays. I do understand that protection is needed for investors, but in the mean time over-regulation is “killing” the markets and keeping new entrants away. Also some participants will need to leave the markets because they don’t have the resources for hiring additional compliance and risk experts.

RMG: finally, what do you think about our Risk Management Guru blog?

PU: I think it is a great initiative. I am really looking forward learning more from other experts and enhancing knowledge by sharing information.

RMG: Pierino, thank you very much for your cooperation and availability for this interview. We will be following you closely.

PU: Thank you!