Jim DeLoach has more than 40 years of experience in global consulting in business, IT, Risk and Internal Audit. He is currently a member of the Protiviti Solutions Leadership Team. Jim has authored several books, including Enterprise-Wide Risk Management: Strategies for Linking Risk & Opportunity (Financial Times Management Briefings) (FT Management Briefings) (the first book […]

Systems and Controls

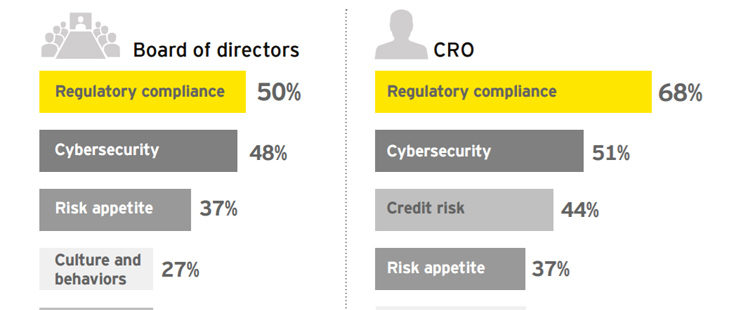

INFOGRAPHIC: Banks Risk Management Survey 2016 by EY

Banks have taken serious steps post-financial crisis to improve and even totally overhaul their Risk Management processes and systems . This has been an enormous challenge for banks as the industry regulation has increased exponentially post-financial crisis with capital and liquidity requirements also increasing. At the same time, CEO’s must keep their focus on increasing banking revenues to 10-15% […]

VIDEO: Risk Management For Project Leaders Webinar

This is another useful webinar by Simplilearn, focusing on the two main dimensions of Risk (probability and impact) as well as the 9 step Risk Management process and other relevant aspects such why Risk Leadership is so important, most common mistakes, root causes identification, among other important points. This is a actually a very thorough […]

Thomson Reuters Culture and Conduct Risk Survey 2016/17

This is Thomson Reuters’ forth annual survey, focusing on how financial services firms are managing conduct risk has identified distinct industry wide trends against which firms can benchmark their own progress. Last year, compliance and risk practitioners from more than 260 financial services firms across the world, including banks, brokers, asset managers and insurers took […]

Updated Rules for Markets in Financial Instruments: MiFID 2

Date: 30.06.2016 A Directive and a Regulation extending the application date of MiFID II and MiFIR by one year have been published in the Official Journal of the European Union. The date of application will be 3 January 2018. The transposition of MiFID II into national laws has also been extended to 3 July 2017. […]

SREP: How Europe’s Banks can Adapt to the New Risk-Based Supervisory Playbook

As a reminder, the main purpose of the Supervisory Review and Evaluation Process (SREP) is to ensure that institutions have adequate arrangements, strategies, processes, systems and controls, as well as capital and liquidity, to ensure a solid coverage of their risks along with sound business management. Risks include all that the organisations might be exposed […]

MIFID (II) AND MIFIR

Whats is MiFID? MiFID is the Markets in Financial Instruments Directive (2004/39/EC). It has been applicable across the European Union since November 2007. It is a cornerstone of the EU’s regulation of financial markets seeking to improve the competitiveness of EU financial markets by creating a single market for investment services and activities and to […]