Banks have taken serious steps post-financial crisis to improve and even totally overhaul their Risk Management processes and systems . This has been an enormous challenge for banks as the industry regulation has increased exponentially post-financial crisis with capital and liquidity requirements also increasing. At the same time, CEO’s must keep their focus on increasing banking revenues to 10-15% […]

Strategy

INFOGRAPHIC: How Does the U.S. Stock Market Perform in Election Years?

Tomorrow is a big day for the American people. It is estimated that over 200m people will go to the ballots, in what is already being considered the most controversial elections in U.S. history. The outcome will be either a Republican victory, with Donald Trump heading, or a Conservative outcome meaning Hillary Clinton will win. One of […]

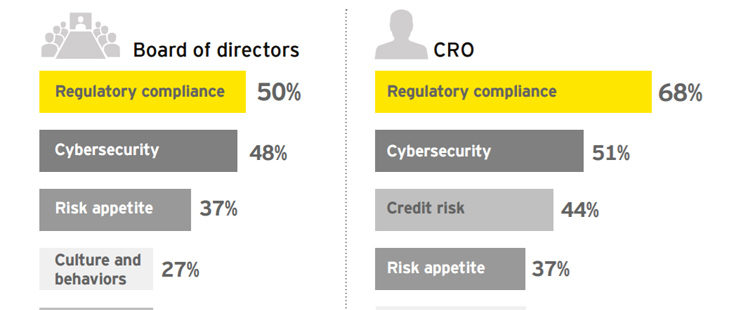

Thomson Reuters Culture and Conduct Risk Survey 2016/17

This is Thomson Reuters’ forth annual survey, focusing on how financial services firms are managing conduct risk has identified distinct industry wide trends against which firms can benchmark their own progress. Last year, compliance and risk practitioners from more than 260 financial services firms across the world, including banks, brokers, asset managers and insurers took […]

EBOOK: Investment Fables

As investors, you have all been on the receiving end of sales pitches from brokers, friends and investment advisors about stocks that they claim will deliver spectacular returns. These stories not only sound persuasive and reasonable but are also backed up by evidence—anecdotal, in some cases, and statistical, in others—that the strategies work. When you […]

How Much Risk Should I Take?

If you read technical analysis reports or any kind of possible “predictive” analysis reports on markets performance – if they have a commercial angle – you will often read the statement “past performances do not guarantee future performances“. This is obviously an important disclaimer that whoever is selling must include in any literature going out […]

Intelligent Risk – PRMIA – October 2016

This issue of Intelligent Risk explores strategic risk and financial institution business models, as well as offers updates on PRMIA initiatives and programs. Inside this issue: Reputational Risk – “How persistent are the effects of negative reputation events?” National differences in risk culture An interview with PRMIA Director of Learning and Development, Mary Rehm Market-risk […]

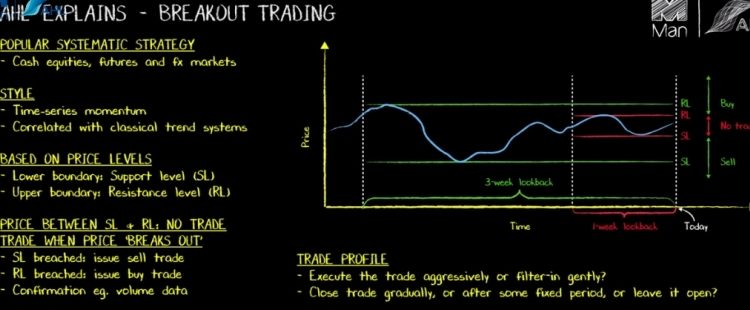

Popular Systematic Trading Strategy – Breakout Trading

London based Man AHL – Leading Quantitative Investment Manager and one of the biggest hedge funds in the world ($19 billion AUM), published a series of videos explaining how maths are the core for their predictive trading tools. The video highlighted below explains “breakout trading,” which is one of one of the most popular systematic […]

McKinsey on Risk

McKinsey’s new publication features the best of its thinking on risk and risk-management issues, with McKinsey’s inaugural issue examining the evolving role of credit portfolio management, regulations affecting European banks, how to manage technology risk, and the value of digitally transforming credit-risk management. The paper also covers: The future of bank risk management Nonfinancial risk: […]