Banks and financial institutions have a current challenge in meeting increasing customer demands. The financial industry has turned to customer relationship management (CRM) technology as a solution to providing a better customer experience from mobile apps to branch locations. CRM has become almost a necessity within the financial services industry to create customer experiences which […]

CRO

Fraud Orchestration Will Keep Banks on Key

Technology is rapidly advancing economic globalization and changing the way consumers interact with businesses all over the world. To meet this new demand, banks and financial institutions are creating new, innovative channels to meet the needs of changing consumer practices. New opportunities but also new financial risks to combat. Financial criminals are always looking for […]

Value and Resilience Through Better Risk Management

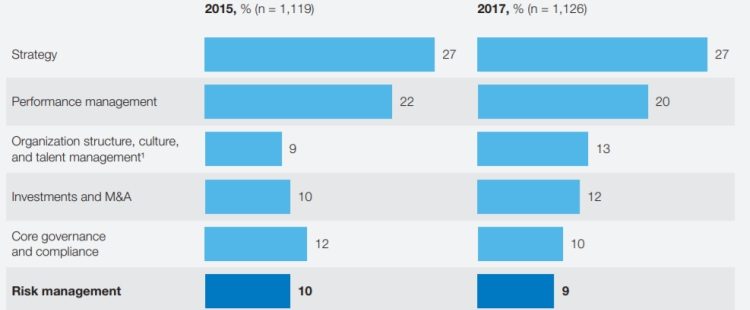

McKinsey has published an insightful article that explores the value and resilience organisations can achieve, by implementing better and solid Risk Management. The first key point that comes to mind as explained by the authors (Daniela Gius, Jean-Christophe Mieszala, Ernestos Panayiotou, and Thomas Poppensieker), is that “although the risk environment is growing more perilous and costly, leading companies […]

Crime Fighting Computers

Advanced technology is taking charge in fighting financial crimes Developments in technology and economic globalization make sending money anywhere in the world faster and easier today than ever before. However, with these developments comes an increasing challenge to identify and prevent financial crimes such as money laundering and other illicit economic activity. The United Nations […]

ModelRisk: FREE Risk Modelling within Microsoft Excel

ModelRisk is a Monte Carlo simulation FREE Excel add-in that allows the user to include uncertainty in their spreadsheet models. ModelRisk has been the innovation leader in the marketplace since 2009, being the first to introduce many technical Monte Carlo method features that make risk models easier to build, easier to audit and test, and […]

7 Key Steps to Implementing a Risk Culture

In any organization, risks are taken on a daily basis. No one could hope to be profitable without them. However, if risk-taking becomes too extreme, it could lead to customer distrust, employee activities that go against stated values, or even the end of operations. Risk-taking doesn’t necessarily lead to financial or reputational damage, but it […]

Creating Value in Operational Risk Management Through Behavioral Science

One of the greatest risks to the success of an organization is human error, an operational risk that exists within every organization. Human errors lead to accidents, legal issues, financial costs, and many other risks that adversely impact an organization all over the world. But what if there were ways to implement human risk control […]

Where Do CROs Come From?

This is a great article by Kate Strachnyi from Risk Articles which shows a very interesting analysis and findings on the role of Chief Risk Officer (“CRO”). The main question driving this analysis was: Where do CROs come from? Using product Tableau, the study displays a visual timeline style chart and relies on key data […]