How can Greece climb out of the current debt crisis gripping its country?

Greece is a beautiful country. If you have ever had a chance to visit her historical temples, walk her picturesque beaches, or sail to any one of her hundreds of islands, you know firsthand the power of her beauty. However, below this beauty, there is suffering. The economic suffering that has been ongoing for close to a decade. Poor politics, greed and corruption have left Greece in a very difficult spot. There is nothing that can be done about the past, but changes must be made if the country will ever breathe economic freedom again. Greece is a wonder of the world, it cannot be allowed to be destroyed by greed and corruption by its own leaders or the European Union.

August 20 of this year, Greece exited the European Union (EU) bailout program. A sign of financial independence the country has been waiting for since 2009. Although debt repayments are scheduled through the next several decades (2059 to be exact), creditors have switched from European governments to mainly German banks. This will end years of austerity measures and financial reforms, allowing the economy to slowly build back to where it was pre-2008. The country is experiencing a slight budget surplus, but unemployment is still at a staggering 20%. Only 5% lower than the United States suffered during the Great Depression.

Young, talented workers are leaving the country in droves and those that stay are finding it hard to find employment, pushing some to join the military based on job security alone. Businesses are also struggling, banks are hesitant to lend money and high taxes to pay off bailout lenders squeeze profit margins even more. Exiting the bailout program was certainly a victory for Greece, but a small one that is not felt by the people of Greece. It will be a very slow recovery for this fragile paradise, but brighter days are ahead.

The writing on the wall – A look back

As Nassim Taleb stated in his book Black Swan, “history is opaque, we see what comes out but do not see the script that produces the events.” In hindsight, we can specifically point back to several conditions which overtime resulted in a catastrophic economic failure to a member of the EU. A failure that threatened other EU countries, and the global financial system overall. Let us travel back in time to review a few conditions that led to this Black Swan event.

Underreported deficits

For many in the international community, Greece adopting the euro in the early 2000’s served as the catalyst for the economic disaster that would later follow. Greece, a member of the EU since 1981, did not meet the Maastricht Criteria, a set of standards needing to be met before the euro could become the official currency of Greece, replacing the former Greek currency, the drachma. A major criteria to join the eurozone is the government deficit cannot be greater than 3% of GDP. To sneak around this criteria, the Greek government pulled a few magic tricks to cook their books to appease the EU. It is reported the gap between what was reported to the EU versus reality was a whopping 7% (reported 1.5%/reality 8.3%).

Cooking the books allowed Greece to gain entry into the eurozone and gain financial protection under the euro umbrella. Over the next several years Greece benefited from the euro, until it was discovered their deficit was a bit larger than reported. However, the EU was stuck as it could not impose penalties against Greece as two of the largest players in the union, France and Germany, were guilty of not meeting the deficit standard themselves. Furthermore, the pressure to keep the euro attractive for the international community and to entice other nations (e.g. UK, Sweden) to adopt the currency only made the problem more severe. Greed and bureaucracy at its finest.

Tax avoidance culture

Greece has a complex tax problem eating away at GDP year after year. Corruption in the form of tax avoidance keeps billions from reaching the Greek government. The level of tax evasion occurring comes out to between 6% and 9% of GDP or 11 and 16 billion euros annually. The main reasons for Greece’s tax woes are overregulation and complication of the tax system, increasing tax burdens, lack of political commitment to treat the tax problem, and negative bureaucracy. When it comes to tax evasion there is always a finger to point. A major concern for Greece is embedded in their business culture and will pose a great challenge to correct.

Greece’s economy consist of a large number of small businesses and self-employed individuals. Very small businesses (0-9 employees) in Greece employ an astonishing 59% of all workers in the country, double the EU average. Small businesses can more easily hide their income by means such as employing undeclared workers or issuing fewer invoices to avoid value-add taxes. The self-employed are also double the EU average and substantially underreport their income to the government, hiding up to 58% of their annual income.

Now this issue in no way is specific to Greece, tax evasion occurs on an international level, from the United States to Bulgaria. However, other countries do not have the level of small business and self-employed, thus diversifying their risk of tax avoidance causing a severe financial impact on the economy. Greece will have its work cut out for them in straightening out this complex issue alone.

Shadow Economy

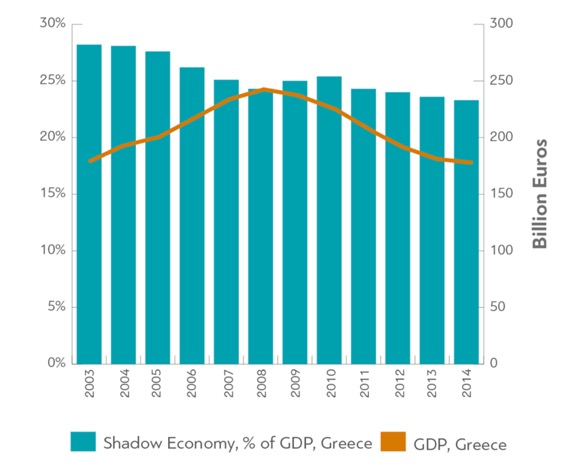

A shadow economy is also aiding in the current Greek tax problems. Illicit economic activity (e.g. black market transactions or undeclared workers) make up a shadow economy, an economy that runs parallel to the country’s official one. An economy which hides in the shadows and eats away at the country’s GDP. Greece’s shadow economy exists in large part due to the amount of undeclared workers operating throughout the country. Undeclared employment has skyrocketed during the crisis, a 2010 audit of 22,000 Greek businesses found that 25% of employees were undeclared.

By 2013 this figured had increased to a staggering 40.5%, increasing a shadow economy that is not helping the current debt crisis. Greece’s shadow economy has been estimated to be at around 20-30% of GDP, a whole 4-5% higher than the EU average. For example, in 2015 the shadow economy made up 22.4% of GDP, or 40 billion euros. Illicit economic activity represents leakage of capital that could go a long way in helping Greece get out of the debt quicksand they are currently standing in. Even more alarming is Greece’s underground economy could be involved in a quarter of all production. This level of illicit economic activity is not sustainable and measures must be put in place to increase GDP while subsequently decreasing unreported economic activity.

What can Greece do?

Two areas where Greece could focus to lower their credit risk while increasing GDP is disrupting their current tax avoidance culture and battling the shadow economy which directly hides tax revenue from being collected. Tackling these two issues could immensely help Greece climb out of the debt crisis and lower the risk of future credit payment defaults.

Disrupt tax avoidance culture

Fighting tax avoidance is not a Greece problem, every country is currently battling this issue on some front. Many other countries have success stories on how they combated tax avoidance, which Greece could borrow to fight its own battles. One of the biggest ways Greece can battle tax avoidance is through increasing the use of plastic money and electronic invoicing which leaves a digital footprint indirectly creating a “fiscal conscious” culture. Second, strict enforcement of tax penalties will help curb tax avoidance practices by small businesses and the self-employed who do not have the capital to risk government financial penalties.

Third, halt tax legislation changes which work against achieving a more simplified tax structure for the government, corporations, small businesses, and the self-employed. Greece has passed an astonishing 250 tax laws since 1975, creating an environment of uncertainty for tax payers and tax collectors alike. Tax policy changes that strike at the root causes will help shift the Greek tax culture towards a more formidable future. A future where taxes are administered and paid fairly, increasing overall GDP to assist in the current debt crisis.

Decrease shadow economy % of GDP

A shadow economy may exist in parallel to the legitimate economy but its impact is adverse to the welfare of the country. Greece must be active in decreasing underground economic activity; one way to reduce the shadow economy’s impact includes increasing electronic transactions. Due to Greece’s current economic tax culture discussed earlier, an incentive plan for merchants and individuals could help decrease cash transactions overall, decreasing the currency used in building a shadow economy. Providing incentives to individuals through electronic card cash rewards programs, prevalent with US banks, and incentivizing merchants by lowering electronic transaction related fees are two small measures that can have a large impact on increasing GDP.

Another way to decrease shadow economy activity is using receipt lotteries. Receipt lotteries could entice consumers to ask for fiscal receipts in exchange for entering a free ticket into a public lottery where attractive prizes can be won. An Osaka university study examined China’s receipt lottery system from 1998 to 2003 in 37 districts finding an increase in operating tax revenues of 17.1% when comparing experiment-included districts to non-included districts. A valuable study showing how receipt lotteries can promote behavioral changes in how consumers act, resulting in increased tax revenue collection. A win, win situation for Greek consumers and the government in helping to decrease Greece’s credit risk.

Wrapping Up

Greece is in a financial battle which will last for some time. A culture of fiscal irresponsibility by all parties must be corrected and set on a sustainable path moving forward. An active shadow economy and tax avoidance culture must be extinguished for Greece to shine once more, and become a strong player in the EU. It will take time and many policy changes but it is not impossible. Every crisis has a solution. Greece need only act and act now to turn the sails toward a brighter future for all her people. In the end, Greece has been in existence for thousands of years, I have no doubt her proud citizens will rise to the challenge to make this country what she once was. Her beauty is unquestionable and will weather the financial winds of the past, present and foreseeable future. Greece will prevail victorious but for now we must wait.