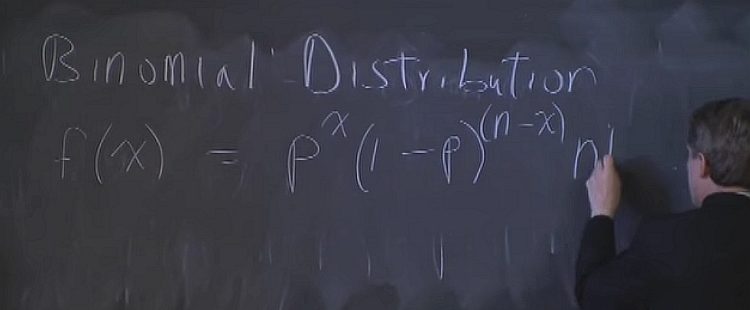

Statistics and mathematics underlie the theories of finance. Probability Theory and various distribution types are important to understanding finance. Risk management, for instance, depends on tools such as variance, standard deviation, correlation, and regression analysis. Financial analysis methods such as present values and valuing streams of payments are fundamental to understanding the time value of money and have been in practice for centuries.

00:00 – Chapter 1. The Etymology of Probability

10:01 – Chapter 2. The Beginning of Probability Theory

15:38 – Chapter 3. Measures of Central Tendency: Independence and Geometric Average

33:12 – Chapter 4. Measures of Dispersion and Statistical Applications

50:39 – Chapter 5. Present Value

01:03:46 – Chapter 6. The Expected Utility Theory and ConclusionComplete course materials are available at the Open Yale Courses website: http://open.yale.edu/courses