In 2013 I was invited to write about the closure of Chinese Harbin Airport due to poor air quality (in other words “smog”).

This article became the second most read entry at globalairportcities.com blog for FY2013 and generated a lot of interesting discussion and positive feedback.

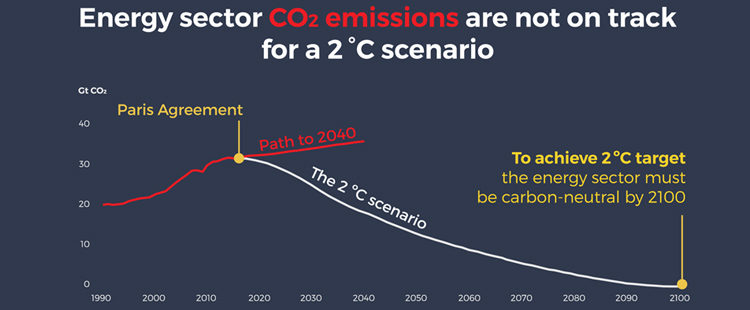

Three years have passed, and besides the United Nation Environmental Programme efforts of creating global policy to curb carbon emissions, the international energy agency 2016 outlook still shows that we are still far from achieving our targets.

With the emergence of populist and nationalist mindset in the west that disregards the importance of achieving global understanding on how to mitigate the risks associated to carbon emissions, preventing poor investment decisions on stranded assets and smoothing the transition to a carbon free economy, the message that this and other articles aim to share are of extreme importance, not just for asset managers, but to all Civil Society.

Is it a Bird? Is it a Plane? No, it’s Smog!

By Duarte Silveira 2013 in globalairportcities.com

Since the beginning of time, large-scale infrastructures such as roads, housing, energy and water networks have been hindered by natural disasters and atmospheric phenomenon, causing major constraints to the populations they served and the economies they supported.

From earthquakes and windstorms, to volcanic eruptions and wild fires, natural disasters were always present during the socio-economic evolution of human societies.

Examples can go as far back as the 856 Damghan earthquake that destroyed what was then the capital of Iran, killing 200.000 people, or the 1755 Lisbon earthquake that floored the entire city and killed 100.000 people. On a more recent note, last year’s Hurricane Sandy that put 50 million people at risk and created $20billion in property damage, or the 2010 Grimsvotn volcanic eruption that closed some of the major European airports for one week, costing the airlines 200€ million per closing day.

To deal with situations of this nature, governments, business leaders and investors create different strategies to minimize the physical damage and financial losses whenever these infrastructures are affected by these unpredictable, unavoidable and one-off disasters.

From innovations in engineering and infrastructure design to the development of insurance and re-insurance services, multi-lateral aid agreements and securitization and derivative products, everything developed and used to hedge the risk, as well as possible damages and losses of severe sporadic natural disasters.

Hence, based on everything stated above, why should one be concerned with another major smog shutdown on the Chinese Airport of Harbin? Why shouldn’t we all carry on with our lives, change nothing and rely on the same old strategies and tools that worked fine until today? Why is this phenomenon any different than from what happened in the past?

For argument sake, let’s assume that the situation in China has nothing to do with changes on the climate induced by human activity. And that what we are witnessing is not one of the many feedback effects that excessive atmospheric carbon emissions can provoke since, according to some ideologies and lines of thought, it is still an unproven matter and requires further research. Instead, let’s focus on the facts.

Now, if we study the data provided to us by several sources such as the Asian Development Bank, the United Nation Statistics Department, the International Energy Agencies and other reports produced by renowned financial institutions and consultancy firms, the conclusions are unanimous. They include: (a) China is the country with the biggest share of atmospheric emissions in the world (b) coal is and will be for years to come, the major source of energy production in the country and (c) automobile purchase is increasing and expected to triple in the next decade, with 20 million new cars being purchased in 2012 making China the biggest auto buyer in the world.

To make the current air quality situation even more challenging, according to the World Bank, Greenpeace and Peking University, ‘particulate pollution’ (or in other words, smog) cost $1 billion to the four major Chinese cities in 2012, and because it’s easy to spend money when the economy is thriving, $100 billion (3% of GDP) is what the country spends in health costs that derive from pollution, mainly air pollution, per year.

Consequently, from a humanitarian perspective, what one is witnessing in China is a calamity on the making that will affect millions of people, if not billions, since neighbouring countries will most likely be affected as well since smog can travel with the wind. This will cause costs – both financial and non-financial – on a scale never seen before.

From a more business-oriented perspective, what one is witnessing in China is a “game changer” and a paradigm-shifter in the risk management and business strategy fields, since one is no longer on the unpredictability realm and there is a clear cause-and-effect relation between a growth strategy and an energy policy with the incidence, increase and repetition of a phenomenon that will pose serious constraints to the normal functioning of the country infrastructures and services, especially in and around major cities, if not reversed.

The recurrence of this incident, is pushing smog into the high probability – high impact quadrant of the risk-event matrix, so when something like this happens, it can’t be no longer managed by hedging tools since it will be unbearable to any business venture or investor to support the costs associated to the latter. Just imagine the insurance cost of an international airport operator that is aware of the high probability that at least once a year, all infrastructure will be shut down for an indefinite time due to low visibility.

Unfortunately, China is increasingly becoming an experiment for the business world to learn how to deal with environmental contingencies that until now had a low-to-none impact on the decision-making process of strategic or investment thinking. In the end, only the savvy leaders with a capability of understanding the connectivity and impacts of several and non-traditional factors and contingencies along long-ranged lines, will be able to be successfully snatch the opportunities that will arise – not just in China – but in a world that is getting increasingly more polluted, warmer and constrained in natural resources.

Read more about pollution crisis is choking the Chinese economy in CNBC.