In any organization, risks are taken on a daily basis. No one could hope to be profitable without them. However, if risk-taking becomes too extreme, it could lead to customer distrust, employee activities that go against stated values, or even the end of operations. Risk-taking doesn’t necessarily lead to financial or reputational damage, but it […]

Risk Management

ERM Adoption Struggling to Keep Pace in Today’s Complex World

It has been a decade since the Great Recession hit our country, threatening to end the American way of life through an economic meltdown. In hindsight, the 2008 sub-prime loan crisis can go down as one of the greatest cumulative risk management failures in U.S. history. When rewards increase, the risks always follow suit, a […]

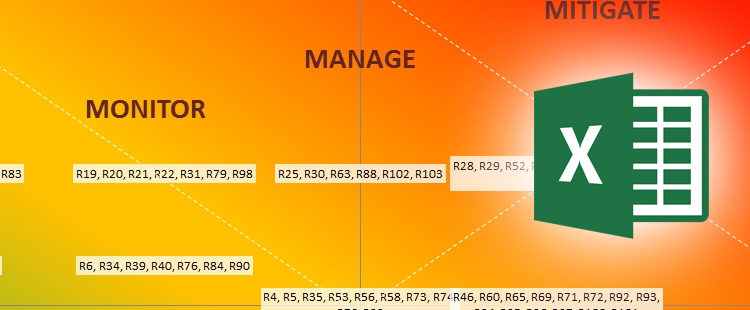

How to Get The Most Out of a Risk Heatmap

Risk heatmaps are a common tool for many risk managers. A risk map is built by plotting the frequency of a risk on one axis of the chart and the severity on the other. Frequency is how likely the risk is or how often you think it will occur, while severity is how much of […]

Social Media Best Practices

Take a stroll through any university campus and you will see countless individuals roaming the social media platforms in their mobile devices. It is everywhere, and it is not going anywhere. Social media, in my opinion, will go down as one of the greatest creations by man, mediums that allow for information to be shared […]

Where Do CROs Come From?

This is a great article by Kate Strachnyi from Risk Articles which shows a very interesting analysis and findings on the role of Chief Risk Officer (“CRO”). The main question driving this analysis was: Where do CROs come from? Using product Tableau, the study displays a visual timeline style chart and relies on key data […]

14 Recommended Governance, Risk, And Compliance Platforms

Global research firm Forrester has analysed and scored a number of Governance, Risk, And Compliance (“GRC”) Platforms and selected 14 significant providers – a few more than a handful. For the assessment of the final provider list, Forrester used a set of 23 criteria points. The resulting report shows how each provider measures up and will help […]

Executive Perspectives on Top Risks for 2018

In the end of 2016 we reported Protiviti’s findings and views on the 10 top risks for 2017, based on Protiviti’s fifth annual risk survey of directors and executives, in partnership with North Carolina State University’s ERM Initiative. Similarly, Protiviti has published their Executive Perspectives on Top Risks for 2018. Highlights resulting from this year’s results Organizations […]

It’s not about Risk Management

This is another excellent post by Norman Marks, renowned author of blog Governance, Risk Management and Audit. Among the several very current and valid considerations made by Norman in this post, illustrated by a meeting held between a CEO, CIO, CRO, EVP Sales and COO of a hypothetical firm, one sentence immediately stands out – and […]