Taking a chance in financial markets implies potential big risks and this is not for everyone. The risk/reward might be high and even if you have every possible rational for a trade well thought, discussed, supported with solid fundamentals and technical analysis, even so, things might go wrong and you might suffer big losses. This bitter reality is many […]

Liquidity Risk

10 Top Risks for 2017

The following report from Protiviti, an international Risk & Business Consulting and Internal Audit company, and North Carolina State University’s ERM Initiative, contains results from the fifth annual risk survey of directors and executives. This report includes their views and the likely collection of risks that will affect their organisations over 2017. Key findings The […]

Risk Assessment of the European Banking System by EBA

The European Banking Authority (EBA) releases a semi-annual Risk Assessment Report which contains updates on risks and vulnerabilities in the EU banking sector. This report describes the main developments and trends that affect the EU banking sector and provide the EBA’s outlook on the main micro-prudential risks and vulnerabilities. Below you can access the Risk […]

Top 5 Risk Management Trading Rules

Portfolio managers (PM) and traders make investment decisions everyday which translate into risk positions in their books. These decisions are mostly supported by strong fundamental views and solid convictions, based on the PM’s or trader’s view on how the market will move and how will these moves affect their positions. There are several techniques that a PM or trader […]

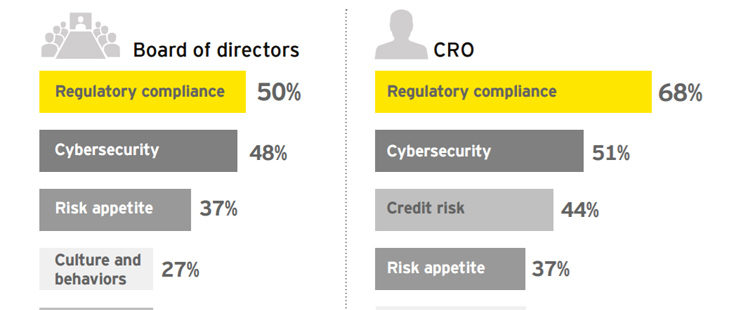

INFOGRAPHIC: Banks Risk Management Survey 2016 by EY

Banks have taken serious steps post-financial crisis to improve and even totally overhaul their Risk Management processes and systems . This has been an enormous challenge for banks as the industry regulation has increased exponentially post-financial crisis with capital and liquidity requirements also increasing. At the same time, CEO’s must keep their focus on increasing banking revenues to 10-15% […]

SREP: How Europe’s Banks can Adapt to the New Risk-Based Supervisory Playbook

As a reminder, the main purpose of the Supervisory Review and Evaluation Process (SREP) is to ensure that institutions have adequate arrangements, strategies, processes, systems and controls, as well as capital and liquidity, to ensure a solid coverage of their risks along with sound business management. Risks include all that the organisations might be exposed […]

MIFID (II) AND MIFIR

Whats is MiFID? MiFID is the Markets in Financial Instruments Directive (2004/39/EC). It has been applicable across the European Union since November 2007. It is a cornerstone of the EU’s regulation of financial markets seeking to improve the competitiveness of EU financial markets by creating a single market for investment services and activities and to […]