London based Man AHL – Leading Quantitative Investment Manager and one of the biggest hedge funds in the world ($19 billion AUM), published a series of videos explaining how maths are the core for their predictive trading tools.

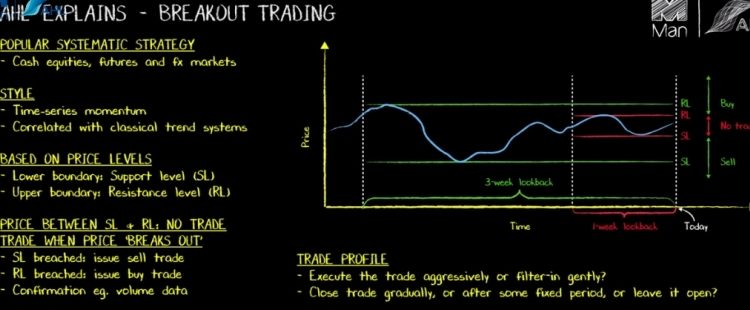

The video highlighted below explains “breakout trading,” which is one of one of the most popular systematic trading strategies at the moment. Anthony Ledford, Man AHL’s chief scientist, says that the strategy is used to trade in different asset classes, namely cash Equities, Futures/Options, and FX markets.

Below you can find a series of other Man AHL videos which were made available last year, covering other topics such as Cross Sectional Momentum, Portfolio Diversification, Risk, Volatility Scaling, among others.

More video on the AHL video series to follow.