Thanks to the rise of chip-based credit cards and person-to-person payment systems, 2015 was a transformative time for banking institutions. But statistics gathered for a recent CDW infographic indicate that 2016 will be no less eventful. The continued shift to digital represents one of the biggest banking trends in the new year. More than 60 […]

VIDEO: Risk Management Webinar – Theory vs Reality

This free webinar, courtesy of IC Markets, focuses on practical and crucial Risk Management aspects to consider from a front office point of view. You will learn what are the important aspects to look for when actively trading in financial markets, including insights on fundamental and technical outlook on all major markets (for indices, FOREX, commodities and others […]

McKinsey on Risk – Volume 2

This is the second issue of McKinsey on Risk (read the first issue on this link), the journal offering McKinsey’s global perspective and strategic thinking on risk. McKinsey’s focus is on the key risk areas that bear upon the performance of the world’s leading companies—including credit risk, enterprise risk management and risk culture, operational risk […]

Build Resiliency With Business Continuity Management

Multinational consultancy company Accenture has been leading efforts and finding the most appropriate solutions for business continuity for its clients. Not surprisingly, their publications are always under our radar and we try hard to keep up with Accenture’s output in several areas, including Risk Management and Business Continuity Management. Things happen…. hurricanes, power outages, systems […]

Top 10 Operational Risks for 2017

Renown and industry leader website Risk.net presents the top 10 operational risks of 2017, as chosen by risk practitioners worldwide. Banks and financial services firms face a range of operational challenges in 2017. In a series of interviews that took place in November and December 2016, Risk.net spoke to Chief Risk Officers, Heads of Operational […]

BIS: Market Risk Capital Requirements FAQ

In January 2016, the Basel Committee on Banking Supervision published the standard Minimum capital requirements for market risk (access the BIS full text here). With the goal of promoting a consistent global implementation of this standard, which is to become the basis for Pillar 1 capital requirements in 2019, the Basel Committee periodically reviews frequently […]

5 Essential Rules for Trading with Futures

A “Futures contract” is a legal agreement between two parties that agree the delivery, from one party to the other, of a specified quantity, of a specified asset, on a specified future date, at a price agreed on the moment of the trade execution. Futures contracts are exclusively exchange-traded (the equivalent OTC instrument is called a […]

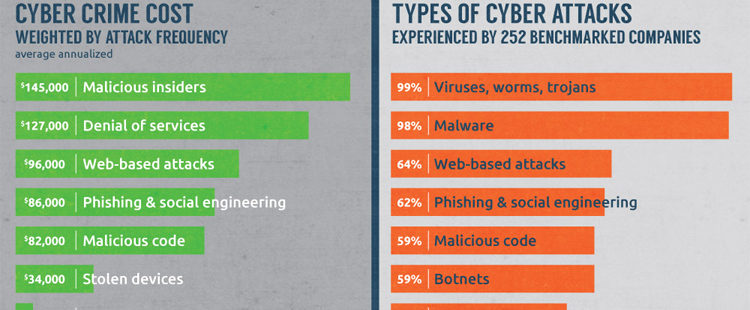

INFOGRAPHIC: What is the Greatest Cybersecurity Threat?

What is nowadays referred to as Cyber Risk is now part of the Top Risks discussed regularly at Board meetings around the world. And this is a fact not only for financial services firms or big banks. Our latest infographic exposes a recurrent question in regarding security: who poses the greater threat to corporate sensitive data: insiders or outsiders? It started with […]