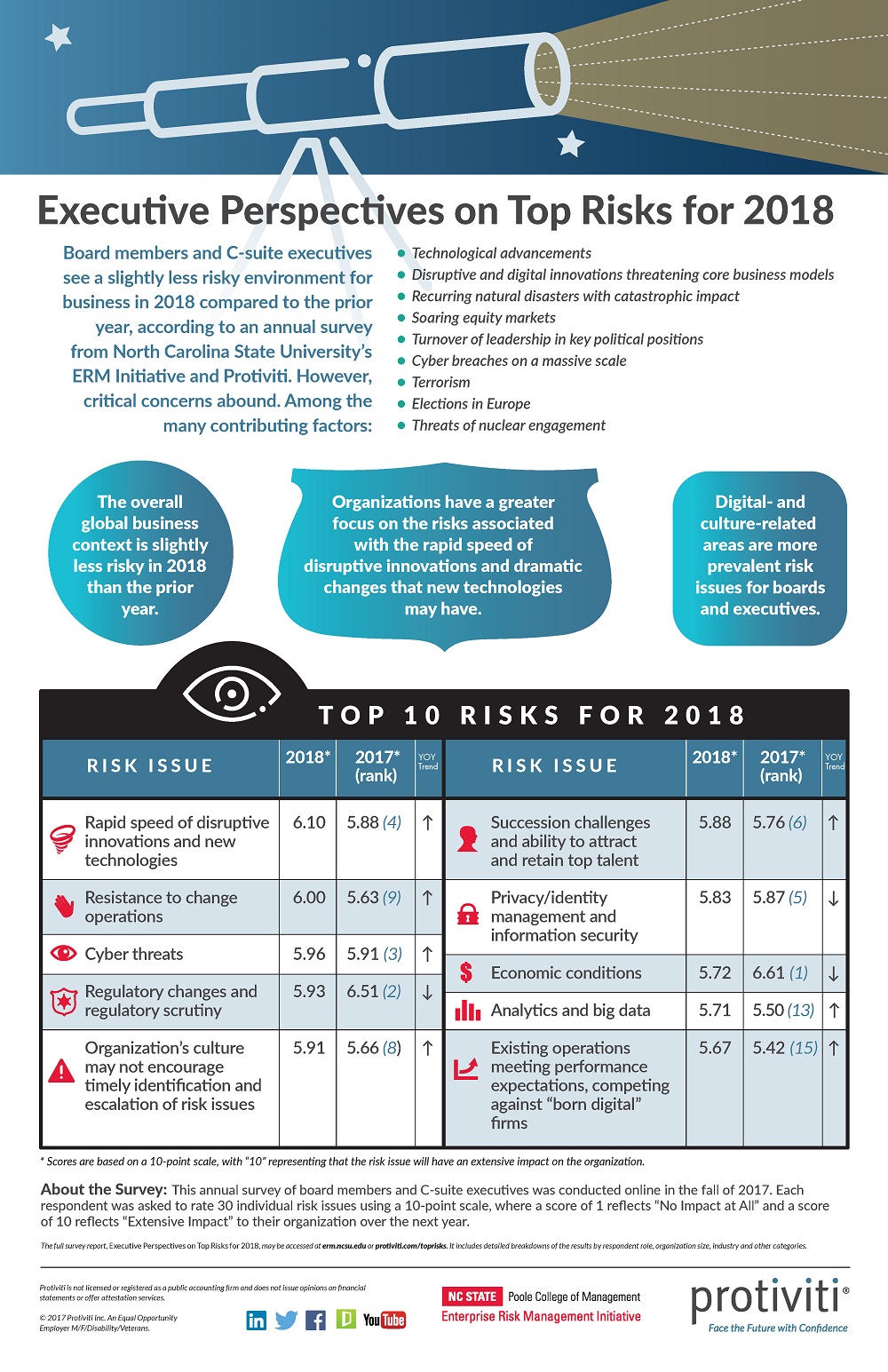

In the end of 2016 we reported Protiviti’s findings and views on the 10 top risks for 2017, based on Protiviti’s fifth annual risk survey of directors and executives, in partnership with North Carolina State University’s ERM Initiative. Similarly, Protiviti has published their Executive Perspectives on Top Risks for 2018.

Highlights resulting from this year’s results

- Organizations have a greater focus on the risks associated with the rapid speed of disruptive innovations and dramatic changes that new technologies may have

- Digital- and culture-related areas are more prevalent risk issues for boards and executives

- … and many other aspects included in the full report (link further down below)

Key findings

- Survey respondents indicated that the overall global business context is slightly less risky in 2018 relative to the two prior years, with respondents in all regions of the world sensing a slight reduction in the magnitude and severity of risks on the horizon in 2018 related to 2017

- Respondents indicated that they are likely to devote additional time or resources to risk identification and management over the next 12 months

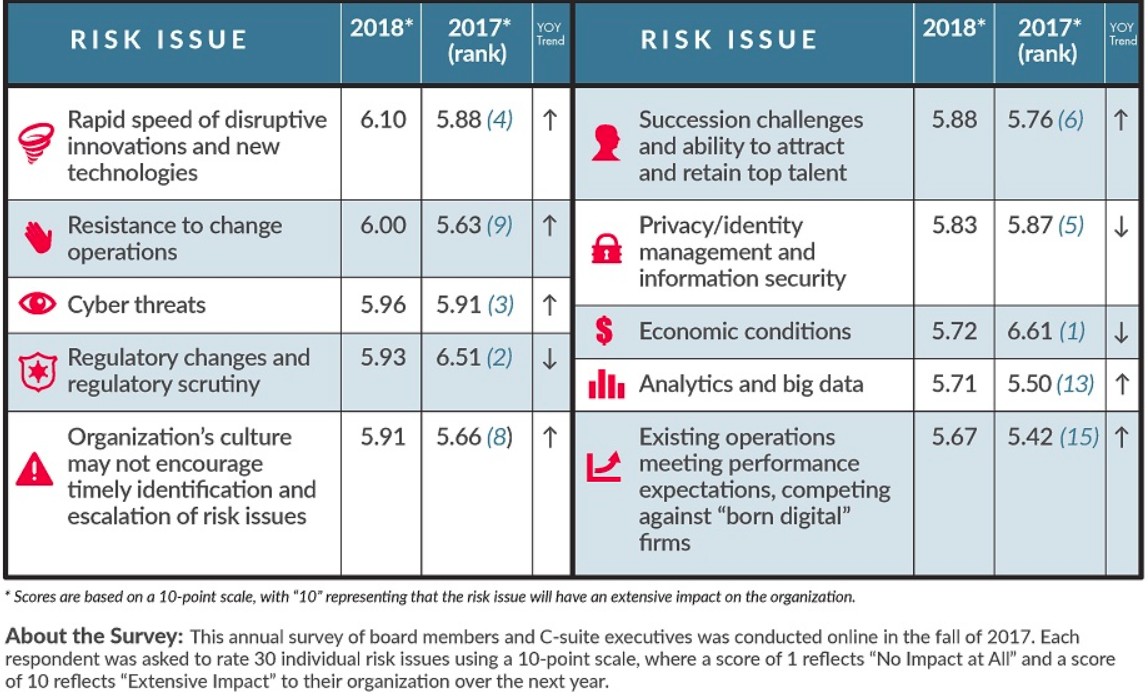

- While respondents indicated slightly less concern about the overall magnitude and severity or risks for 2018 relative to the two prior years, there are noticeable shifts in what constitutes the top 10 risks for 2018 relative to last year

Similarly to last year’s findings, we can still see that Cyber threats, regulatory changes, the speed of technology changes and corporate culture continue to appear in the list of the 10 global risks for 2018.

Overall Top 5 Risks

As a summary of the conducted survey, Protiviti came up with a list of the Overall Top 5 Risks – below along with our own comments.

| Top 5 Risks | Our comment |

|---|---|

| 1. Rapid speed of disruptive innovation/technology | The high speed at which technology is evolving and potentially disrupting certain businesses raises concerns, certainly in the eyes of regulators. New paradigms and distributed technologies such as blockchain and crypto- related solutions increases the need for sophisticated systems and controls at firms |

| 2. Resistance to change | In our view, this risk should appear… always. Resisting change can be as damaging as other external risks. Change is inevitable, as is continuous change in business and economic conditions. People are usually adapted to what they know and are often reluctant to change. This may happen due to various reasons (we will write more about the risks in change management in a dedicated article) |

| 3. Managing cyber threats | Materialising risks resulting from cybersecurity issues are a great concern nowadays. The resulting negative effects of such issues might cause a firm’s core systems to stop working and create serious or even permanent disruption. Currently considered one of the most significant operational risks |

| 4. Regulatory change and heightened regulatory scrutiny | This continues to be considered by a great part of the respondents (59%) as a “significant impact” potential risk. Many firms struggle to keep up with the increasing regulatory changes and regulatory scrutiny. Have you ever heard the expression “from no regulation, to over-regulation“? Many practitioners and senior managers at financial services firms and banks are constantly arguing about this point |

| 5. Culture may not encourage timely escalation of risk issues | Overall culture in organizations is a growing risk and this study shows that. The wrong or unadjusted culture, coupled with resistance to change, can be extremely damaging to organisations. The IRM defines culture as “An effective risk culture is one that enables and rewards individuals and groups for taking the right risks in an informed manner”. Many aspects need to be considered in order to implement the right and sound culture – this is also a topic for a dedicated article in future. A classic example describing this issue is the fact that a firm’s culture might prevent someone to come forward (i.e. whistle blow) and prevent the timely mitigation of a real risk. |

Video – Executive Perspectives on Top Risks 2018 Survey Results

Infographic

Download the Full Report (PDF)

Click on the link below to access and download the full Protiviti “Executive Perspectives on Top Risks for 2018” report (PDF, opens in a new browser window).