The regulatory landscape for risk management in financial services is constantly evolving, presenting a formidable challenge for firms and Banks striving to comply and manage their risk profiles effectively. Drawing from the collective wisdom of seasoned risk managers, our goal with this article is to delve into the key challenges and practical strategies that can […]

Regulation and Supervision

Risk Assessment of the European Banking System by EBA

The European Banking Authority (EBA) releases a semi-annual Risk Assessment Report which contains updates on risks and vulnerabilities in the EU banking sector. This report describes the main developments and trends that affect the EU banking sector and provide the EBA’s outlook on the main micro-prudential risks and vulnerabilities. Below you can access the Risk […]

Leverage and Risk Weighted Capital Requirements

The global financial crisis has highlighted the limitations of risk-sensitive bank capital ratios. To tackle this problem, the Basel III regulatory framework has introduced a minimum leverage ratio, defined as a banks Tier 1 capital over an exposure measure, which is independent of risk assessment. Using a medium sized DSGE model that features a banking […]

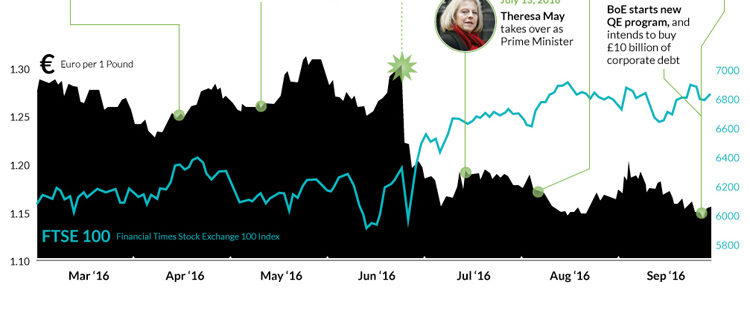

INFOGRAPHIC: The Aftermath of the BREXIT Vote

Many experts predicted a BREXIT calamity if the UK voted to leave. Leave was the outcome and the question now posing is: were they right? Take a look at the last three months and the aftermath of the BREXIT vote. BREXIT “doom and gloom” appears to be mostly exaggerated (so far) For the first half of […]

Updated Rules for Markets in Financial Instruments: MiFID 2

Date: 30.06.2016 A Directive and a Regulation extending the application date of MiFID II and MiFIR by one year have been published in the Official Journal of the European Union. The date of application will be 3 January 2018. The transposition of MiFID II into national laws has also been extended to 3 July 2017. […]

The return of fiscal policy – A step in the right direction by Nouriel Roubini

Nouriel Roubini is a widely known professor at NYU’s Stern School of Business, and was senior economist for international affairs in the White House’s council of economic advisers during the Clinton era. He has also worked for the IMF, the Federal Reserve, and the World Bank. Since the global financial crisis of 2008, monetary policy […]

SREP: How Europe’s Banks can Adapt to the New Risk-Based Supervisory Playbook

As a reminder, the main purpose of the Supervisory Review and Evaluation Process (SREP) is to ensure that institutions have adequate arrangements, strategies, processes, systems and controls, as well as capital and liquidity, to ensure a solid coverage of their risks along with sound business management. Risks include all that the organisations might be exposed […]

MIFID (II) AND MIFIR

Whats is MiFID? MiFID is the Markets in Financial Instruments Directive (2004/39/EC). It has been applicable across the European Union since November 2007. It is a cornerstone of the EU’s regulation of financial markets seeking to improve the competitiveness of EU financial markets by creating a single market for investment services and activities and to […]